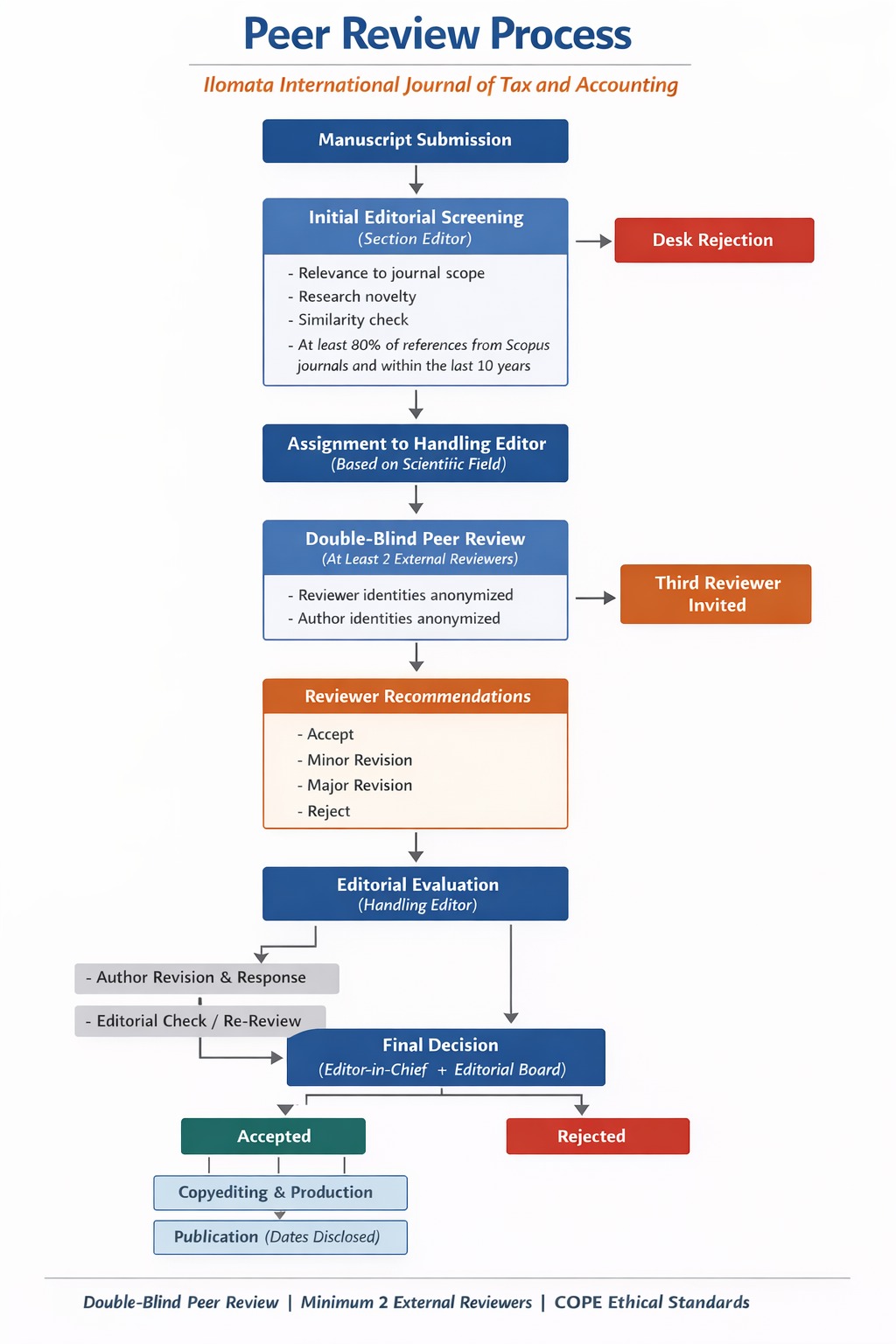

Peer Review Process

All manuscripts submitted to Ilomata International Journal of Tax and Accounting undergo a rigorous screening and review process to ensure that they fit into the journal's scope and are of sufficient academic quality and novelty to appeal to Ilomata International Journal of Tax and Accounting readership. Ilomata International Journal of Tax and Accounting employs a double-blind peer review, in which both author(s) and reviewers identities are concealed from each other.

Initial screening by Editorial Team (internal). The Editor-in-Chief will screen a submitted manuscript to ensure its conformity to the Ilomata International Journal of Tax and Accounting scope and basic submission requirements. The Editor-in-chief will assign an editor based on the articles’ scientific field.

Peer-review by external. If the manuscript passes the initial screening stage, it will be assigned to a handling editor, who will then send it to at least two experts in the relevant field to undergo a double-blind peer-review. Manuscripts that fail to pass the initial screening will be rejected without further review.

First decision internal and external. A decision on a peer-reviewed manuscript will only be made upon the receipt of at least two review reports. In cases where reports differ significantly, the handling editor will invite an additional reviewer to get a third opinion before making a decision. At this stage, a manuscript can either be rejected, asked for revisions (minor or major), accepted as is, or (if significant changes to the language or content are required) recommended for resubmission for a second review process. If it is accepted, the manuscript will be returned to the submitting author for formatting. The final decision to accept the manuscript will be made by the Editor-in-Chief based on the recommendation of the handling editor and following approval by the board of editors.

Revision stage by internal. A manuscript that requires revisions will be returned to the submitting author, who will have up to three weeks to format and revise the manuscript, following which it will be reviewed by the handling editor. The handling editor will determine whether the changes are adequate and appropriate, as well as whether the author(s) sufficiently responded to the reviewers' comments and suggestions. If the revisions are deemed to be inadequate, this cycle will be repeated (the manuscript will be returned to the submitting author once more for further revision).

Final decision by internal. At this stage, the revised manuscript will either be accepted or rejected. This decision is dependent whether the handling editor finds the manuscript to have been improved to a level worthy of publication. If the author(s) are unable to make the required changes or have done so to a degree below Ilomata International Journal of Tax and Accounting standards, the manuscript will be rejected.